On Wednesday, Chancellor Jeremy Hunt announced a new vaping tax that will affect anyone using an e-cigarette. We’ve run the numbers, and it looks like this new tax could have a massive impact on how we all buy and consume our e-liquid.

In this week’s article we’ll show you exactly how much the Vaping Products Duty will add to your monthly e-liquid bill. We’ll explain when it starts and help you save on e-liquid in the run-up to October 2026.

Vaping Products Duty: key facts

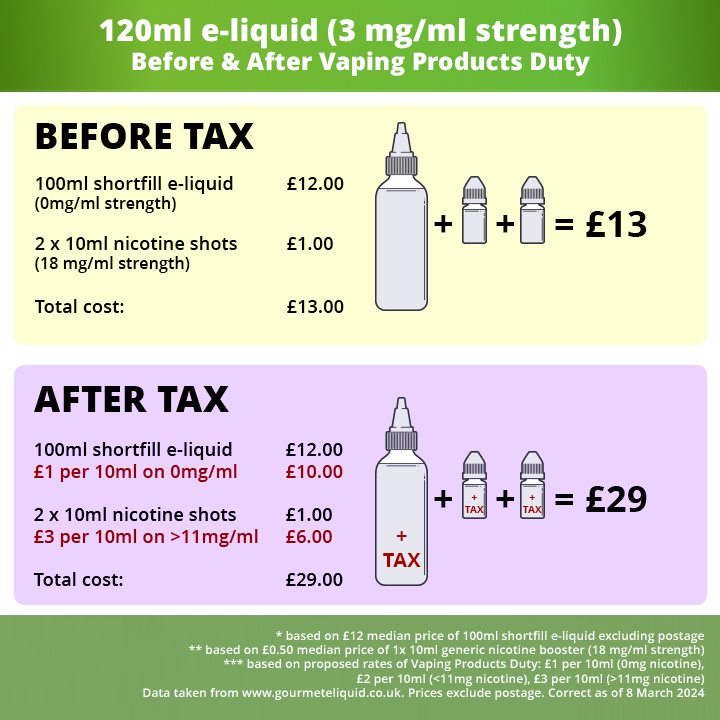

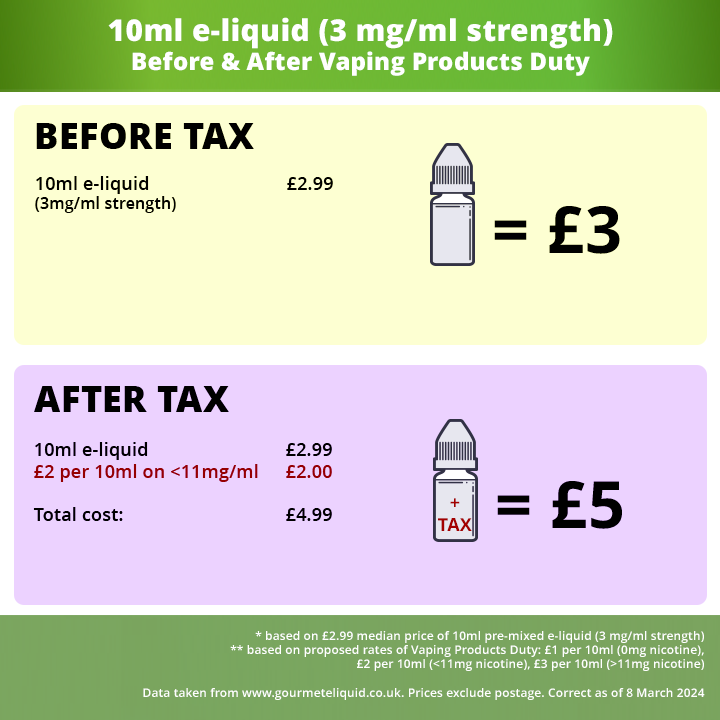

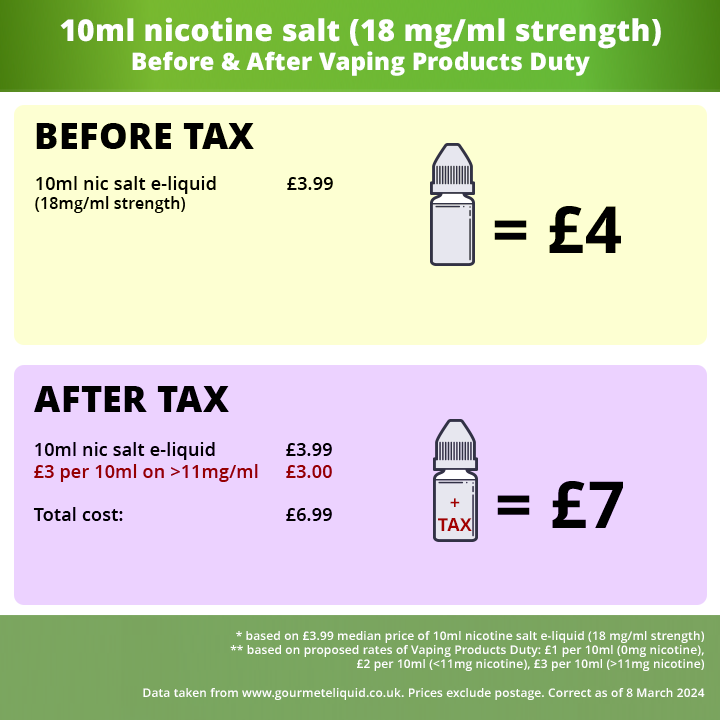

Vaping Products Duty, announced Wednesday 6 March 2024 in the Spring Budget, is a brand-new tax on vaping, forecast to raise almost half a billion pounds in revenue by 2029. The new tax is due to kick in from 1st October 2026 and will add at least £1 per 10ml to the price of all e-liquid sold in the UK. The planned rates are…

- An extra £1 per 10ml for nicotine-free (0mg/ml) e-liquid

- An extra £2 per 10ml for medium strength (0.1-10.9mg/ml) e-liquid

- An extra £3 per 10ml for full strength (11mg/ml or more) e-liquid

The government plans to increase tobacco duty at the same time so that it still makes financial sense to choose vaping over smoking (see points 2.43 and 5.31 in the budget announcement here). Based on our calculations, this new tax could end up changing how people bulk-buy e-liquid, because mixing your own shortfill won’t be as cheap as it once was.

How much is it going to cost vapers?

The amount of Vaping Products Duty you’ll need to pay, over the course of a year, will vary depending on two things: how often you vape and how much nicotine you put in your e-liquid.

Based on the purchasing behaviour of our regular customers in 2023, we estimate the average vaper can expect their e-liquid bill to go up by around £55 a year. There aren’t many ‘average’ vapers out there, however. Around one in ten vapers consume a very small amount of no-nicotine e-liquid — they can expect their annual bill to sneak up by around £6. On the other hand, heavy vapers (high-volume, full-nicotine e-liquid consumers) could end up paying £220 or more on top of what they’re already spending.

What will taxed vape juice cost per millilitre?

At the moment, most of the vape juice we sell is nicotine-free shortfill e-liquid. Our customers usually add separate bottles of high-strength nicotine to their order, then mix the nicotine and shortfill together at home. Right now, this is the cheapest way to bulk-buy e-liquid (learn more on our shortfill guide). Prices vary, but if you buy 100ml of e-liquid and then add your nicotine at home, it normally costs around 11p per ml. This is much cheaper than buying a 10ml bottle of pre-mixed e-liquid, which can cost around 30p per ml.

Once the new vape tax comes in, 100ml of shortfill (with 2x10ml nic boosters to make 3mg/ml nicotine strength) will cost around 24p per ml.

Vapers who buy a 50ml shortfill bottle (with 1x10ml nic booster) will pay 33p per ml once the tax kicks in.

And anyone buying a 10ml bottle of 3mg/ml strength e-liquid will pay around 50p per ml.

It’s even tougher, price-wise, if you vape full-strength nic salts. 10ml of nic salts is set to climb from 40p per ml to a whopping 70p per ml.

Disagree with this new vape tax? Tell the government by 29 May!

When we first heard the Chancellor’s statement about a new vaping tax, we were disappointed. Vaping is not perfect, but it does help thousands of people in the UK to successfully quit smoking every year.

The argument for taxing vapers is that it will “discourage non-smokers from taking up vaping and raise revenue to help fund public services like the NHS” (source: gov.uk). This ignores the fact that the vast majority of vapers are ex-smokers. Any reputable retailer will tell a non-smoker that they should not vape. It also ignores the fact that, as vaping helps more and more smokers to kick the habit, the long-term pressure that smoking puts on the NHS will continue to decline.

Thankfully, there is a way to have our voice heard. The government has opened a 12-week consultation on the proposed Vaping Products Duty. This consultation closes on 29th May 2024 so act now if you want your opinions on this new tax to be considered:

https://www.gov.uk/government/consultations/vaping-products-duty-consultation

When all is said and done, vaping is still a lot cheaper than smoking. It still has the potential to help the UK become a smokefree country. We hope that the government thinks twice about these new vaping taxes, but even if they don’t, we’ll still be here, doing what we can to provide our customers with the very best e-liquid for the very best price.

Stay safe and happy vaping!

John Boughey